🦄 vol. 44

sash chats about amazon's imminent launch in africa 🥵

🥳 woohoo! we’re proud to announce our first-ever collaboration with preamble - the coolest source of afrocentric & data-driven content at the moment! keep an eye on our instagram page and make sure you subscribe to their newsletter for more info.

the everything store 🛍

ICYMI (because of load shedding 🤡): An Amazon document was recently leaked, revealing the company’s proposed plans to launch its online marketplace in Africa - starting with 🇳🇬 & 🇿🇦 in 2023. If true, it’ll likely prove to be a game-changer for online retail on the continent… because this could either spell the beginning of the end for local incumbents, or push the whole ecosystem forward.

First, a brief look at Amazon 🤓

Amazon was founded in 1995, originally as an online bookstore. 📚

Today, its online marketplace operates in 10+ countries around the world and ships goods to well over 100. 🌎

The Amazon stable also includes the likes of AWS - its kinda big (South African founded) cloud business that generated $60+ billion in revenue in 2021… amongst others. 📈

Amazon had a total consolidated net sales revenue of ~$470 billion in 2021. 🤯

It also happens to be one of the biggest employers in the US. 🏭

But just to be crystal-clear, we’re talking about the launch of its online marketplace here.

So what does this (imminent) launch actually mean? 👀

Let’s dive straight in. 🤿

Suppliers and smaller retailers are licking their lips… 🤤

Over 50% of units sold on Amazon in Q4 '21 were from 3rd party sellers - essentially retailers / suppliers who publish their products on Amazon, but fulfil their own orders. Simply put, Amazon becomes an additional (and credible) sales channel, where you can expand your reach… for a fee, of course.

Consumers don’t really mind… 🤷🏽♂️

Unless you’re hell-bent on supporting local business, Amazon’s entry to market = more options for you as a consumer… and likely downward pressure on prices (thanks to Amazon’s economies of scale).

Media owners and platforms are nervous… 😰

Amazon’s marketplace comes with its own ads offering - essentially to boost your products on the home and results pages. This will likely mean that a share of retailers’ current paid media budgets will shift towards Amazon (and existing media owners and platforms will lose out).

Lastly, local Incumbents are (probably) sweating… 🥵

I sincerely hope that the incumbents have had this under the “threats” (or opportunities) column in their SWOT analyses for some time now… because this was bound to happen at some stage.

The threat is obvious: A loss of market share is to be expected, thanks to Amazon’s global brand appeal; superior economies of scale; advanced supply chains; access to global markets and goods, etc.

There are also opportunities: Mergers and acquisitions? I can’t imagine too many players turning down an M&A knock-on-the-door from Amazon.

Whether it be fighting off Amazon, or joining forces, who are these incumbents that are likely to be in the firing line?

Local players 🌍

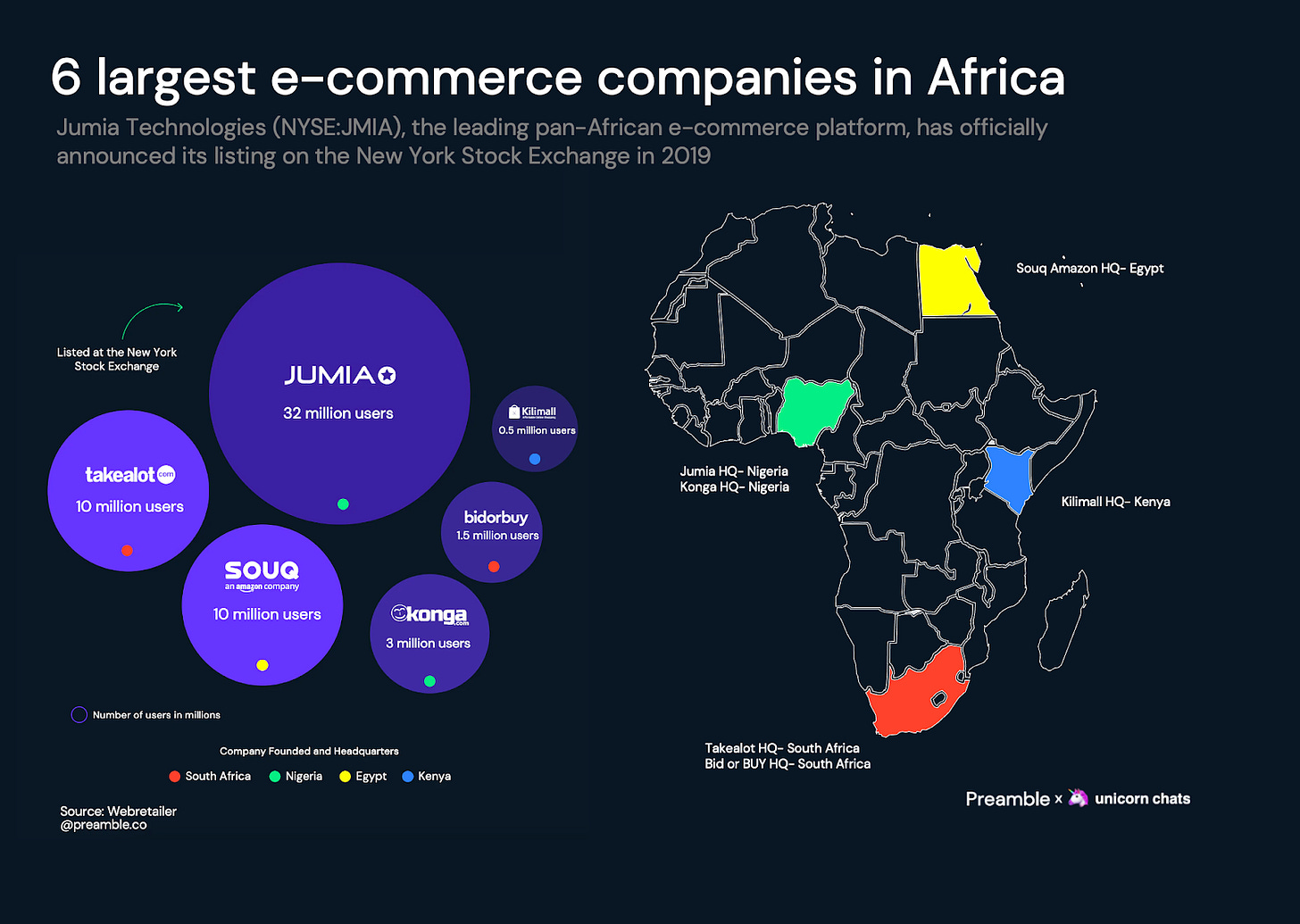

Here’s a few marketplaces you may have heard of…

Jumia (🇳🇬) - Conservatively forecasted to hit ~$190+ million in revenue in 2022.

Kilimall (🇰🇪) - Conservatively forecasted to hit ~$25+ million in revenue in 2022.

The Takealot Group (🇿🇦) AKA Takealot, Superbalist and Mr D - Announced $820+ million in revenue in its 2021-2022 financial year.

Notably, as per their most recent annual results, more than 50% of gross merchandise value on takealot.com came from 3rd party sellers. 💡

But it’s probably not just the marketplaces who are feeling the pressure…

The pandemic accelerated the online grocery pivot too 🛒

In the South African grocery industry, we’ve seen the likes of Checkers take the lead and launch Sixty60; Pick n Pay acquired Bottles (and announced a partnership with Mr D); and Woolworths launched Woolies Dash.

And while Amazon does technically have a grocery offering, I think it’s highly unlikely that they’d try and compete in this space… initially. There are too many moving parts, and local grocery retailers pretty much have their supply chains on lock.

Baby steps. 🐾

So what’s in store? 🔮

Amazon’s marketplace expansion into Africa is inevitable.

What is clear is that the ball is clearly in the incumbents’ court:

Do they try to fight them off and test the stickiness of their customers? 🥊

Do they strap in, invest heavily in tech advancements and supply chains, and create new and innovative offerings? ⚙️

Do they dabble in the realm of M&A? 💰

Or do they move too slowly and RIP? ⚰️

The African optimist in me would like to see some resistance.

sash

following vol.42’s look at the current vc climate, karl enjoyed this quartz article pointing out how africa’s vc ecosystem’s focus on primary needs has helped weather the market downturn

sash loved preamble’s post about the most powerful passports in africa