🦄 vol. 37

anda (this week's guest) chats about the world of daos

some say he brought internet to africa, others point out that he learnt how to install fibre before he could whistle 😚. nevertheless, anda is helping phd students and entrepreneurs convert their theses and ideas into blockchain startups as the coo of the algorand-uct financial innovation hub.

how about dao? 👀

Since the beginning of the year, we’ve already seen over $1 trillion worth of crypto wealth disappear. And if we narrow it down to last week alone, crypto markets have had over $200 billion in value wiped off. In fact, the collapse of TerraUSD saw hundreds of investors lose over $40 billion in what is being labelled as “Crypto’s Lehman Brothers moment”.

Unfortunately, this isn’t the first time crypto markets and projects have been in the news for all the wrong reasons… and it probably won’t be the last. What’s interesting is that despite all of these events, resources continue to pour into crypto. Investments in cryptocurrencies and blockchain ventures by venture capitalists haven’t slowed down this year with 70+ M&A deals concluded in 2022 so far, compared to ~50 in Q1 2021. But why do so many people continue to buy into this volatile ecosystem?... For the purists, it’s the promise of democratisation. ✊

The key 🔑

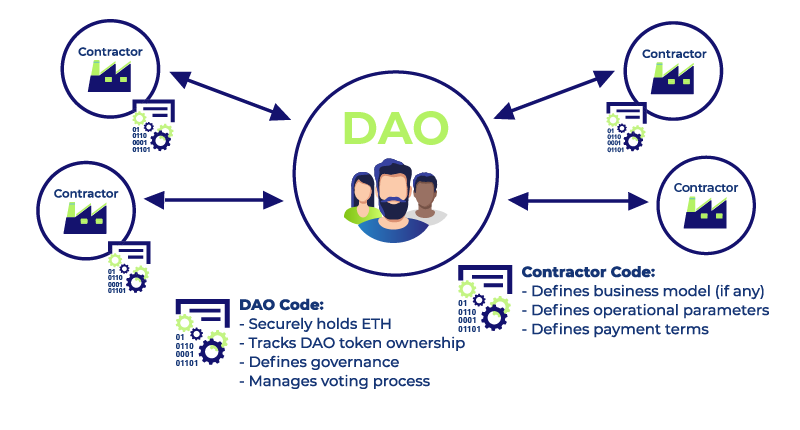

Democratisation has always been at the core of blockchain technology. It exists in everything from the underlying financial system to the organisations and communities established to maintain them. You see, in traditional organisations, corporate governance serves as a key pillar to attract investors. But in the modern day, we’ve seen the rise of Decentralised Autonomous Organisations (DAOs), which no longer have a dependency on corporate governance as we know it. How exactly? By using blockchain technology to solve the principal-agent conundrum. 🤝

The principal-agent conundrum 🤓

Imagine voting for someone in an election because they say all the right things, but when it comes to actual implementation, they don’t deliver as promised. The person you voted for only does things to serve their own self-interests, leaving you powerless and annoyed. In this instance, you’re the principal and the person you voted for is the agent. In a nutshell, this is the principal-agent conundrum.

How do DAOs solve this? 🧐

🤝 Shared responsibility: DAOs use community governance as opposed to assigning responsibility to a manager. This means that the power lies in the hands of the individuals who do the work, instead of someone who spends most of their time delegating tasks.

🚔 Transparency and accountability: DAOs encode governance rules and procedures into the underlying smart contracts (digitised agreements on the blockchain that automatically execute when certain terms are met) developed at their inception. This is why people say DAOs are governed by code instead of leaders.

🪙 Incentivisation: To incentivise people to contribute to the maintenance of a project, DAOs distribute tokens which can be exchanged into cash. While this part sounds cool on paper, code is susceptible to cyber attacks, placing people’s money at risk. The first DAO ever created lost $50 million in a hack.

Nonetheless, DAOs aren’t slowing down…

Where are we now? 👀

In 2021, more than 970,000 people were members of various DAOs across all blockchains. This growth has been largely driven by the underlying use cases that DAOs support. Some interesting examples:

ConstitutionDAO raised $47 Million to participate in a Sotheby’s auction to purchase one of the original copies of the US Constitution.

UkraineDAO raised $3 million for the Ukraine Army.

Krause House DAO raised $4 million in a week to try to purchase the Chicago Bulls.

VitaDAO has raised and deployed $2 million to further research in Biotech.

DAOs and Africa: A new solution to age-old problems? 🌍

Closer to home, I’d say DAOs can offer new solutions to age-old problems. Take microfinancing for example: Although strides have been made when we look at the total amount of African Microfinance Institutions (MFIs) growing by 56% since 2012, there is still room for improvement if we really want to address financial inclusion. A DAO could be used to bring together various stakeholders in microfinancing with a shared purpose and automate governance and the distribution of funds. The use of a DAO in this instance removes intermediaries and puts financing small businesses at the core of its operations. This can reduce administrative and management-related costs, thereby increasing the amount of funding available for those who need it.

My sentiment towards DAOs remains bullish when we look at the momentum they’ve gained in the space of 6 years. With COVID-19 having completely changed the way we work, DAOs present a unique solution that puts the autonomy in our hands to decide where, when and how we work. Individuals can contribute time and resources to multiple DAOs simultaneously across the world without being confined to one entity through an employment contract. By offering an alternative to traditional corporate governance, we will see far more applications of DAOs that enable democratisation where it is needed most.

anda

sash thinks that altro –a startup that helps you build a credit score by paying for your netflix subscription– is seriously cool

matt found this podcast useful in breaking down the recent ust-luna debacle that unfolded in crypto this week (and which anda referred to)

if you want a quicker breakdown on the ust-luna death spiral, karl enjoyed this thread

Incredible article that is well articulated, but simple enough for any layman to understand. These are the solutions that are tailor-made to hope resolve the unique challenges Africa currently faces when it come to management or mismanagement of funds.

I long to see our own country, SA, adopt DAO in our government systems and MIFs