🦄 vol. 31

sash chats about music streaming in africa

30 editions in, and we think now is the perfect time to try a few new things. our first experiment: 1x piece per week. we’d appreciate your anonymous feedback too!

stream battles (part ii) 🌍

In vol. 28 I took a brief look at the history of music streaming and did a deep(ish) dive into the global listener share in the current music streaming market. And while a handful of big platform players have emerged, there are no surprises that Spotify is currently leading with ~33% of the global listener share. But what’s happening a lil’ closer to home? 🤔

A closer look at Sub-Saharan Africa (SSA) 🌍

It’s no secret that on paper, the SSA region has some of the right indicators for a booming future digital economy. Here’s a few (mind-blowing) stats to wrap your head around:

📶 Mobile service subscriptions will grow to 615 million people by 2025, equivalent to 50% of SSA’s population.

📱 Smartphone adoption will grow from 48% (2020) to 64% by 2025.

💰 Economic value added by mobile technologies and services will reach $155 billion by 2025.

And from a content perspective, one only has to look as far as the rise of Amapiano over the past 3 years, and the resulting global success of the likes of Major League DJz (amongst many others), to know that there’s an array of untapped talent in the region.

So naturally, you’d think the music streaming giants would be flocking here, right? 🤔

Not really in a hurry... 👀

Spotify, “the biggest music streaming platform in the world”...

Founded in 2006, only launched in SA in 2018 🤯... but has since scaled to more SSA countries.

In Q1 2022, had ~1.9 million monthly active users (MAUs) in South Africa, Nigeria and Kenya (SSA 3) combined, as per Apptopia.*

Now beginning to seriously invest in SSA creators with launchpad programmes that help emerging artists achieve long-term and sustained career success.

*Disclaimer: MAUs are not necessarily paid subscribers; 3rd party MAU data is also only available for SSA 3.

But do the unit economics make sense? 🧐

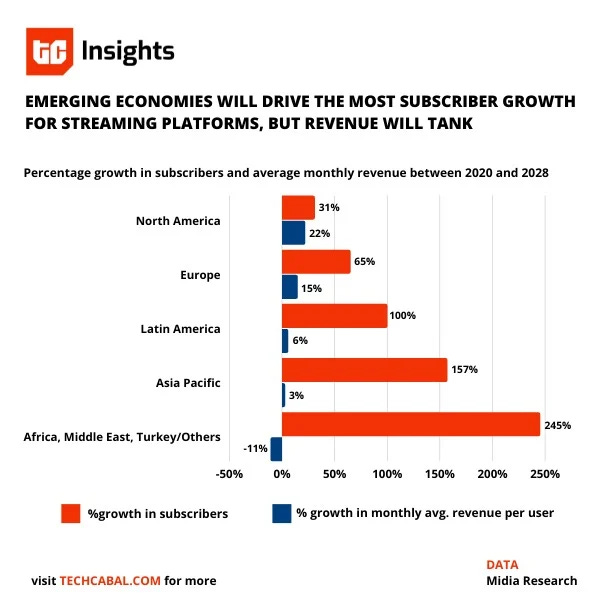

While a big chunk of new music streaming subscriptions are forecasted to come from emerging markets, the average revenue per user in emerging markets is significantly lower than developed markets. See diagram below:

Let’s take a look at the current Spotify pricing plans per country:

🇺🇸 USA: $9.99/month

🇬🇧 UK: ~$13.18/month

🇿🇦 SA: ~$4.12/month

🇰🇪 KE: ~$2.60/month

🇳🇬 NG: ~$2.16/month

Average price of 🇿🇦 + 🇰🇪 + 🇳🇬 (SSA 3): ~$2.96/month

While these pricing plans are set inline with each country’s user spending power and population, it creates a new challenge to acquire a greater volume of subscribers in regions like SSA. For example, you’d have to acquire ~3.4 monthly subscribers in SSA 3 to generate the same monthly revenue as 1x American subscriber. Granted, the target population required to achieve that scale exists, but acquiring new subscribers in a developing market is likely to be a resource intensive operation. Basically, it’s a longer-term play.

So who else is eating? 🍽

While Spotify arrived in true African time, a few lesser-known players jumped at the opportunity and captured some of the market:

💥 Boomplay:

Founded in NG by Transsion (Chinese mobile manufacturer).

Comes pre-installed on all Transsion devices (Transsion is responsible for more than 40% of smartphone sales in Africa) 🤯.

Claim to have 60+ million active users*; Although Apptopia reports ~740K MAUs across SSA 3 in Q1 2022 👀 .

Freemium model; paid subscribers can download music and listen offline.

Not focusing on paid subscriptions for now as a means to combat piracy and later upsell to premium subscribers.

The majority (70%) of the music being streamed is from the continent too.

*Disclaimer: It isn’t clear how Boomplay defines an “active user”.

Founded in USA, but focused on SSA.

Apptopia reports ~862K MAUs across SSA 3 in Q1 2022.

Freemium model; paid subscribers can download music and listen offline.

Partnered with MTN (biggest telco on the continent) for streaming data packages.

Audiomack’s UpNow program focuses on discovering new talent, and is responsible for contributing to the rise of Omah Lay.

Takeaways 🍔

While SSA has many of the right indicators, it’s evident that the likes of Spotify had not always prioritised the market. I guess you can’t really blame them for the late entry… The unit economics in SSA clearly make for a longer-term play.

But of course, as Spotify stalled, they left food on the table.

And as we wait for other big tech products and services to launch in SSA, I can’t help but wonder whether Boomplay and Audiomack have given us somewhat of a blueprint? First-movers with a clear strategy to piggyback on telcos and hardware manufacturers' reach (see my piece on oligopolies) and to scale through freemium models with the aim to upsell into premium subscribers later on...

I’d say, let’s wait and see how their paid subscribers (and subsequent revenue) match up in the next 5 years.

sash

sash was shook to learn that $1 trillion was processed by the mobile money industry in 2021

matt loved this pod with morgan housel, the author of psychology of money