🦄 vol. 29

adrian (guest) and karl chat about crypto in the voluntary carbon market and debunking exponential growth

we hope you enjoyed your long weekend! today’s feature is adrian (from vol.26)… the guy who got expelled twice and has a twisted interest in carbon markets. the people wanted more, and so here he is. find him on linkedIn or twitter and if the below spikes your interest - check out refidao!

crypto x climate 🌍

Hey! Last time I was around, I wrote about why government regulated and voluntary carbon markets are promising tools to combat climate change.

This time, it will be about why and how crypto (as in blockchain, not currencies) can change the voluntary carbon market (VCM) for the better.

Carbon market problems 🤧

The VCM thrives thanks to corporate pledges to reduce and offset hard-to-reduce carbon emissions. And that’s a good thing because we have to turn off the carbon tap and empty the pool in order to survive.

However, the VCM—a $1 billion market—is pretty unstructured and unregulated. It’s the wild west and full of shenanigans. The most significant pain points are:

🤢 Double-counting and greenwashing: The financial damage caused by dubious projects runs into high millions. Every single year. You can find many legit-looking projects that do not exist in reality. Some of you may remember the VW carbon footprint scandal or the Coldplay disaster.

😶 Credits are semi-fungible: A tonne is not a tonne is not a tonne… in other words, carbon credits are not a commodity. Each credit comes from a specific project with specific characteristics and co-benefits. So every tonne is different and has a different price point.

🤯 Intermediaries and accessibility: You’d think buying credits is as easy as shopping on Amazon. But nope, there’s a lot of friction.

As the number of pledges, projects, and climate-related investments have exploded in recent years, so have concerns about greenwashing, fraud and reputational risk. Consequently, the market is placing more and more emphasis on quality, transparency, and traceability.

Crypto to the rescue 🩹

Let's point out the elephant in the room: Crypto isn’t a silver bullet. But it does have some answers to the problems mentioned above:

🕵 Transparency and traceability: Blockchain can provide a new level of data availability and transparency. Combine it with real-time monitoring data and you automatically strengthen the integrity of carbon credits. Better measurement, reporting and verification equals better credits.

🌳 Tokenization and commercialization: You can tokenize nature, meaning creating a digital twin of your climate performance. For every sequestered carbon you get a token that you can then sell. Think of NFTs but instead of buying digital artwork you're buying sequestered carbon.

🤝 New incentive models. Thanks to new decentralised ownership business models, people have started to experiment with regenerative financial (ReFi) models. Most of our business models today are extractive, meaning you invest in a system and take money out of it. But with ReFi, money created in the system stays in the system.

Even if you ignore the hype, crypto opens up new financing possibilities that didn’t exist before. Lots of smart people are now working on regenerative finance solutions with the goal to grow and scale climate projects.

Final verdict ⚖️

With new transparent infrastructures, data-rich auditable carbon tokens, new financing options for climate projects, and enough liquidity, you’ll attract more climate projects. This is good for the VCM and ultimately for all of us because companies then avoid the mediocre credits in the VCM and are finally able to buy the impactful stuff.

Btw, check out Senken, and contribute to our ongoing Gitcoin Grant.

adrian

it’s not exponential 🚫

When I say startups, you think growth. In fact, you likely think of exponential growth, and from there, start to think about the network and virality effects in tech startups that supposedly make this kind of scale possible. Guilty 👀 ? Yeah, me too.

The thing is, we toss the word ‘exponential’ around so loosely. It’s time to understand what we actually mean. Jason Cohen, from Smart Bear, offers some guidance.

🚀 Exponential: y = 2^x → In exponential growth, values grow by a multiple over a specific time interval. The compounding effect of multiplication causes the numbers to grow slowly initially, then sky-rocket. This is shown with the red line in image A.

e.g. You grow to 10 daily active users (DAUs) in year 1, in year 2 to 100 and in year 3 to 1000—each time the amount of growth is multiplied by ten.

🪜 Quadratic: y = x^2 → In quadratic growth, values grow by adding a constant amount more to the prior growth figure at each time-interval, rather than multiplying a constant amount more at each time-interval. Think step changes. Initially, this is much faster than exponential growth but in the end, the stamina isn’t there.

e.g. Using the same example, growing in year 1 by 10 (to 20), then in year 2 by 20 (to 40) and in year 3 by 30 (to 70). See Image B.

Real world 🌍

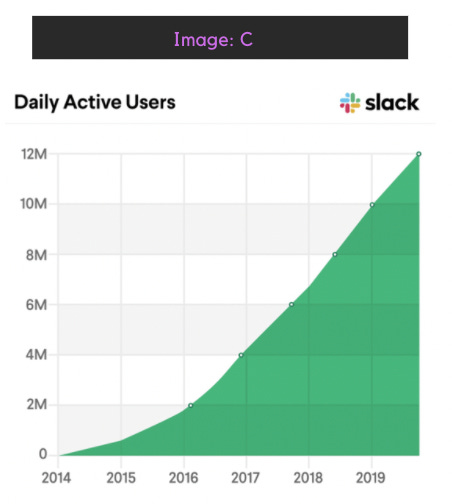

Slack, a sensational pivot story, is known as the fastest-growing enterprise software company ever, going from $0 to $10m annual recurring revenue (ARR) in their first 10 months, and 0 to 10,000,000 active users in just five years. Does this equate to exponential growth?

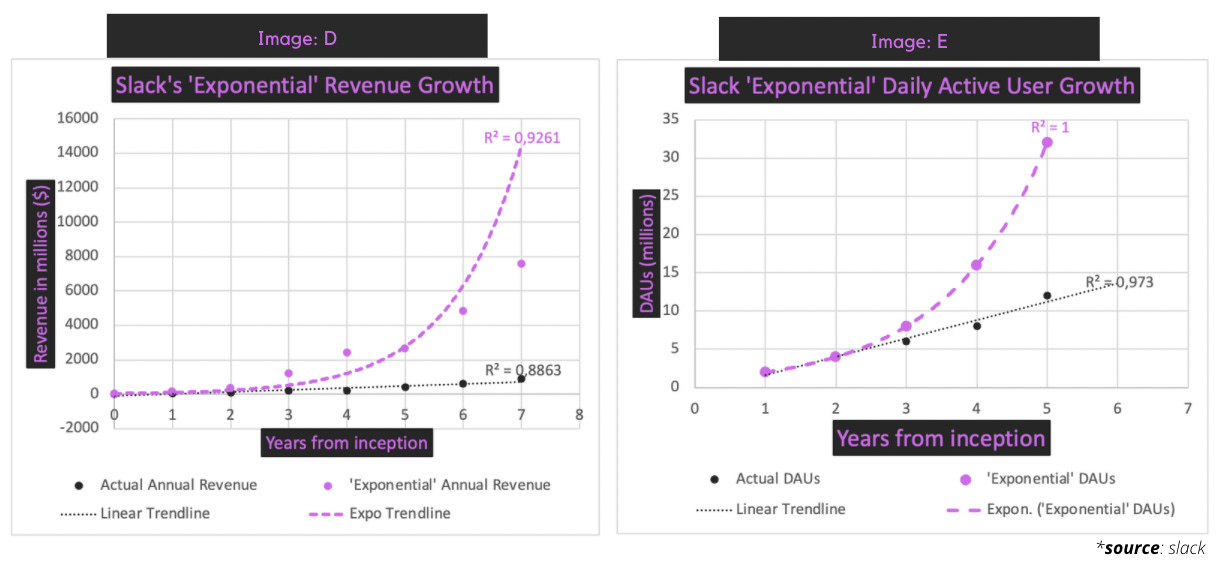

Nope - its initial DAU growth followed that of a quadratic function and then slowed down to a linear function. Let's assume that it had followed an exponential function for both the ARRs and the DAUs💡:

ARR 💰

As shown in image D, if Slack actually had exponential growth from their 2014 base year with $12m of ARR, in 2021 they would be sitting close to $8 billion of ARR. In reality, their 2021 ARR figures were just below $1b at $902m. That's 738% lower. 🤯

The pink trend line is used to illustrate the potential exponential growth. This is contrasted to the black linear trend line used to illustrate the best-fit line of their actual revenue growth. The actual ARR maintains quadratic characteristics for much of the duration and becomes linear towards the tail end, however, this cannot be seen in image D given the distortion from the exponential figures 🤷🏽♂️.

DAU 👥

As shown in image E, if Slack actually had grown DAUs exponentially they’d have 32 million users. This is compared to their 12 million DAUs in reality as of 2020. Only 3 million of these users are premium users.

For context, Microsoft Teams sat at 75 million in 2020 and doubled that to 145 million in 2021. I wonder if that growth was exponential. 😉

Considering that an exponential graph tends to infinity, sustained exponential growth for users would be impossible. There are only so many people in the world and in Slack’s addressable market. More aptly put - Slack’s carrying capacity would be hit… invalidating the exponential function. To account for this, we use a logistic function that grows exponentially for a period and then levels off - but enough with the graphs for today.

So what next? 🧐

We’ve only scratched the surface, but nonetheless laid the foundations for a model that unpacks growth at high-growth tech companies. We’ll build on this and see how different verticals layer on one another to push companies to actual growth.

karl

sash was impressed to learn about moove’s $105 million series a2 funding round

karl was inspired by this piece on the myth of exponential growth