🦄 vol. 24

kumbz and claude chat about sports analytics and central bank digital currencies

introducing our third feature: kumbz is a professional rugby player, currently playing for soyaux angoulême xv in france (and previously the stormers and the sharks). concussions aside, kumbz is actually an academic too… with a bcom degree from uct, and a whole lotta interest in sports analytics.

databall 🎱

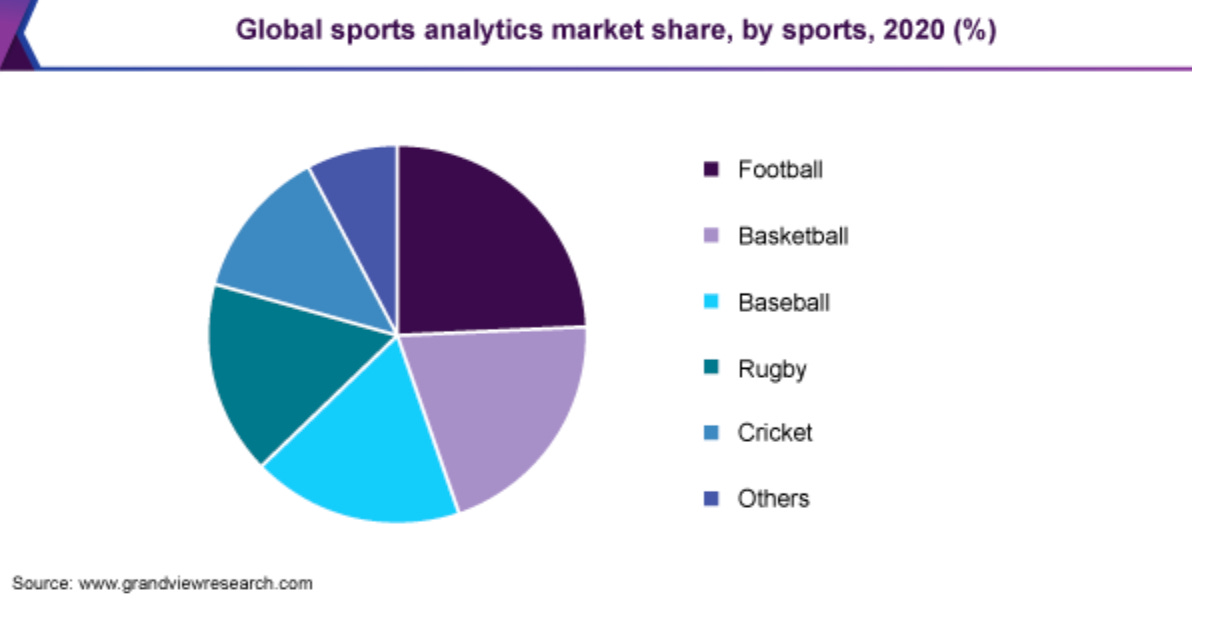

In 1974 statistics met computers and formed the super team known as data science. Today, it’s the application of data science in sport that has led to the whopping ~$900M sports analytics market. That number is projected to grow to around $3.4 billion by 2028. 🤯

From the first time I took a skinfold test and pulled a GPS vest over my head as a pro rugby player, I've had an interest in the science behind sports. I’ve since learnt how raw data can be processed into meaningful (and actionable) insights across almost every sporting code - something I am particularly intrigued by. 🤓

Use cases? 🧐

Athletes 🥇

Closely monitoring key health metrics while analysing footage is an athlete’s version of homework.

Examples 🤓:

Video analysis software companies like Dartfish aid athletes in movement specific sports (think golf or athletics) to better their biomechanics.

Wearables, like WHOOP, are helping athletes track their resting heart rates, sleep cycles and hydration levels (these data points are major 🔑s for optimal athlete recovery).

My experience 🏉: Players and coaches use HUDL to watch and distribute video clips, post or pre-game statistics, game plans and tactics they may want to use - or diffuse if analysing opposition. Most training sessions are filmed and made available on HUDL so players can assess their own mistakes and know what they need to work on for continuous improvement.

Coaches, biokineticists & medical staff ⛑

A combination of software and wearable tech is used to aid planning and decision making. Ever wondered why your favourite player was randomly subbed off before halftime? Coaches use this data in real time too! 😂

Examples 🤓:

Nacsport helps create tactics for the upcoming opposition, assess player performance and even prepare presentations for team meetings.

On-field player tracking software such as Zebra Technologies (used in the NFL) tracks data from wearable technology on players.

Products such as Catapult GPS can track collision metrics, heart rate, speed, acceleration, and body positioning.

My experience 🏉: The medical teams use GPS data from games and training sessions to manage player loads for injury prevention (many injuries stem from overuse). This same data is used to top-up the loads of players who are underperforming to make sure their fitness levels are maintained. GymAware and the Wattbike Hub are also commonly used in gym sessions to track players' explosiveness.

Management & fan engagement #️⃣1️⃣❤️

Increasing fan engagement and diversifying revenue streams is also 🔑 for sport management teams (especially since the COVID-19 pandemic).

Examples 🤓:

My experience 🏉: As a fan, I've also enjoyed the advancements in the broadcasting of rugby games globally. The most notable being the 8K footage provided by NHK Labs, as well as the 360° clips and in-game statistics provided by Canon at the 2019 Rugby World Cup in Japan.

So what’s in store? 🔮

With new and exciting opportunities for students, and companies like IBM making big strides in data collection across major sports, we are set to continue seeing real advancements in this space. There will soon be nowhere to hide with all the data (and insights) at our disposal. As Jay-Z once said: “Numbers don’t lie, check the scoreboard!” 🗣

kumbz

central bank digital currencies 💰

Wait, don’t we already have digital currencies? 🤔

There are many definitions of “digital currencies” and these can pertain to:

Centralised digital currency: Currency that can be exchanged electronically by the use of EFTs, debit or credit cards.

Decentralised cryptocurrencies: These are unregulated offerings like Bitcoin (BTC) and Ethereum (ETH) issued by a network, and not any central authority or government. Their value is volatile in nature, but they can be exchanged for goods and services.

Stablecoins: These run on blockchain technology, the difference is that the value of tokens is pegged to something that already exists such as the US dollar or gold, etc. This tethering of value reduces the volatility of these types of tokens.

Central Bank Digital Currencies (CBDCs) are the hypothetical blockchain-based form of digital currency that would be issued by a national state and have an official legal tender status. A Bison Trails report says that more than 80% of central banks across the globe are exploring the use of CBDCs and various central banks have already begun prototyping them.

Citing a report by the International Monetary Fund (IMF):

In China, the digital renminbi has more than a hundred million individual users and billions of yuan in transactions.

In the Bahamas, the Sand Dollar has been in use for over a year.

To understand the drive for CBDCs, it’s necessary to have a high level conceptualisation of the function of our current monetary system.

How does the monetary system currently work? 🧐

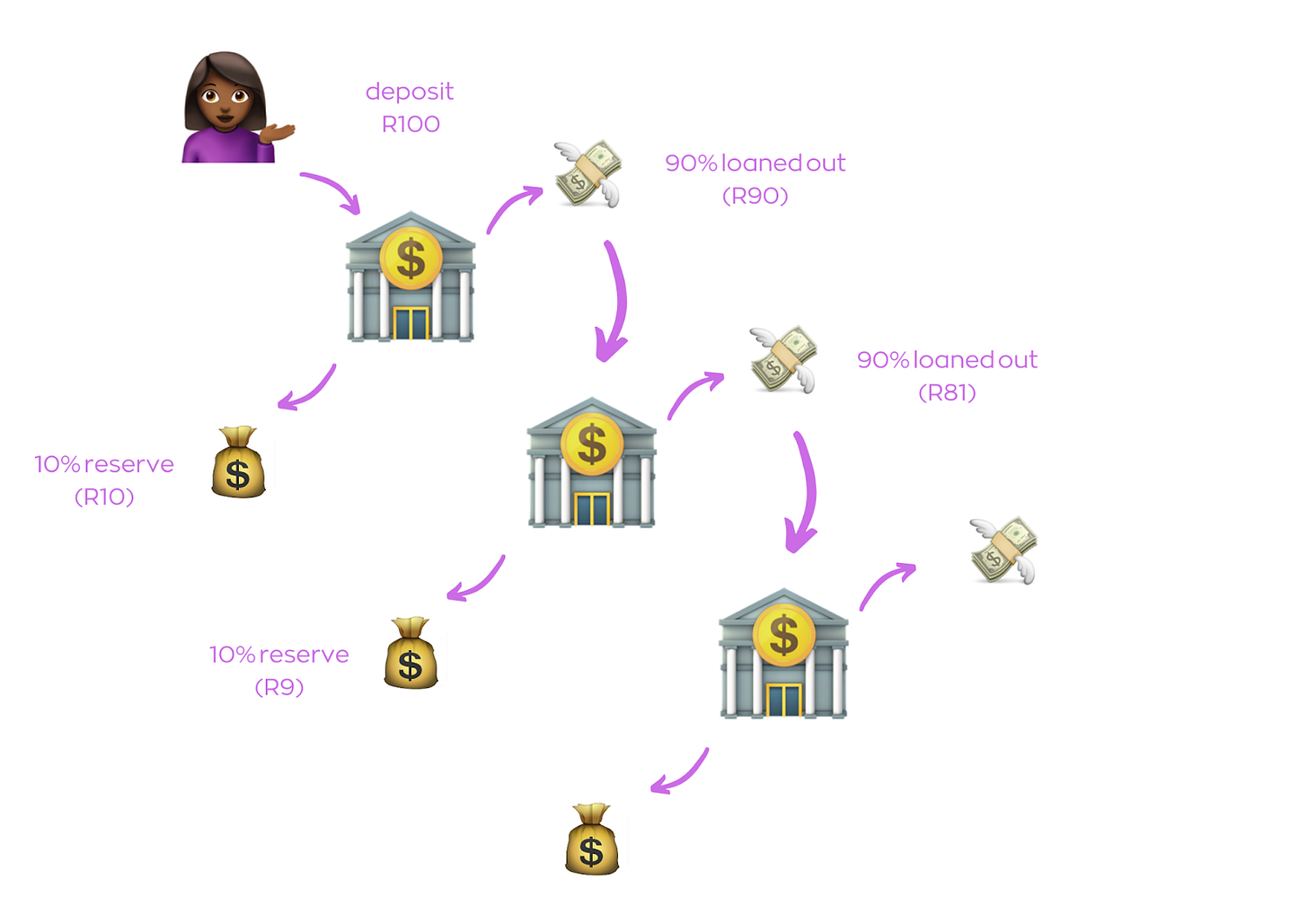

Banks operating in most countries are based on fractional reserve banking. This is a system in which a bank is required to hold only a portion of customer deposits on hand, based on the reserve rate, while being free to lend out the remainder. As an illustrative example:

Given a reserve rate of 10%: A person deposits R100 in a commercial bank, 10% is reserved, leaving the remaining 90% to be loaned out by the commercial bank… and the cycle continues. This increases the amount of money in circulation.

Bank reserves are held as cash in the commercial bank itself, or as balances in said commercial bank's account at the central bank of a particular country. The changing of the reserve rate is part of monetary policy and one of the tools used by central banks to control the overall supply of money.

So why CBDCs? 🤓

While centralised digital currency falls under control of the central banks, they are wary of decentralised cryptocurrencies and stable coins because:

They cannot control the supply of them.

Mass adoption of these alternatives would threaten the sovereignty of national currencies.

This would make it harder for them to implement effective monetary policy because the central bank cannot influence the supply by tweaking the reserve rate, for example.

If you can’t beat them..

Where is the value? 👀

There are conceptually two types of CBDCs:

Wholesale CBDCs: these are used to facilitate payments between central banks and entities that hold accounts with the central bank (e.g. commercial banks).

Retail CBDCs: these would be currency issued in your wallet directly from the central bank.

Wholesale CBDCs are concerned with solving inefficiencies in the plumbing and infrastructure of the financial system. While we can expect that they will improve the speed and efficiency of reserve settlement, they have little direct impact on individuals.

Retail CBDCs make a strong case for financial inclusion and increased efficiency. For example, if the central bank could issue money directly to people’s phones. Some compelling scenarios could arise:

⏱ Stimulating the economy in times of economic downturn: Think about issuing stimulus with an expiry date to encourage spending to spur the economy.

🚨 Relief provision during natural disasters: The central bank could directly distribute funds to individuals in hard-to-reach areas.

Are CBDCs the future of digital currencies? 😯

Given that various countries are at different stages in their development (and facing different challenges), we would expect the development of a CBDC to be tightly tied to the specific country’s context. The success thereof will likely also be tied to the competencies and diligence of organisations overseeing their implementation.

claude

inspired by claude’s piece, karl went down a rabbit hole and learnt that the british government is funding its own cbdc research

after matt’s piece on pandemic stocks, sash was interested to find out that nike and amazon are considering acquiring peloton