🦄 vol. 14

matt and karl chat about buy now, pay later and black economic empowerment in the asset management space

can i pay later? 💳

If you've found yourself filling your Superbalist or Takealot carts a little more regularly since the start of the pandemic, you can be comforted by the fact that you're not alone. It's becoming more evident that the pandemic has likely changed our lives forever, and it seems that its impact even extends to what we're buying and how we're paying for it.

How did things change? 🤔

Panic buying aside, consumers spent more on household cleaners and soap, coffee and hair colouring, while things like sun care and cosmetic products saw double digit declines. More interestingly, and perhaps expectedly, we saw a shift from brick-and-mortar stores to e-commerce sites — with South African e-commerce growing by 66% in 2020. Takealot, while likely absorbing the losses from traditional retailers, grew its revenue by 41% in the same period. But I'm far more interested in how we, especially millennials, are funding this growth.

How are we paying for all this? 😬

If you keep your eyes on start-up news, you'll be well versed in fintech start-ups. From an African perspective, 48% of venture capital flowing into the continent's startups in the first half of 2021 went to fintech. And August was a good month for a certain niche fintech vertical: "buy now, pay later" (BNPL).

After markets caught news of Amazon's pact with BNPL player Affirm, the start-ups shares soared 43%.

Jack Dorsey, founder of Twitter and Square, announced the acquisition of Australian Afterpay for $29 billion to provide BNPL-services for the latter.

PayPal couldn't resist, forking out $2.7 billion for Paidy as a means to penetrate the Asian BNPL market.

Even Apple announced it plans to partner with Goldman Sachs in order to offer BNPL services to its Apple Pay users.

Buy now, pay later is... 👀

Exactly what it sounds like. It's a point-of-sale financing model that allows consumers to purchase products, and pay off the cost in a set of instalments, often with minimal to no interest and typically with less punitive charges. As an example, Amazon shoppers will now be able to split purchases of $50 or more into smaller, monthly instalments after the partnership with Affirm.

Lipstick on a (proverbial payments) pig? 🐷💄

Up until now, most consumers fund purchases (and 'defer' payments) with credit cards, making up for their lack of liquidity. But, we've seen a shifting sentiment with regard to credit cards in recent months.

Weirdly enough, BNPL isn't a novel concept: merchants have long offered point-of-sales payment structures to drive purchases. But with the growing transition to e-commerce and digitally native consumers, BNPL has received a second wind by providing a more attractive payment option at checkout.

But why not credit cards? 💳

BNPL players are shifting the costs from the consumers (think high fees, interest and late payment charges with credit cards) to the merchants themselves. For BNPL start-ups, monetisation occurs through charging the merchants a percentage of the fee paid by the consumer.

Wait, why would any merchant agree to that? 🏦

BNPL helps merchants drive sales, increase conversion rates and improve transaction sizes at decent percentages. Here are some of Klarna’s numbers:

The financing options increases average order value (AOV) up to 60% in cases, allowing consumers to buy items they can't necessarily afford at point of checkout.

Conversion rates also see a 20% increase when BNPL is offered as an option, preventing those half-filled-never-purchased carts.

Implications for Africa 👊

BNPL remains a relatively nascent service on the continent, and with a growing body of consumers hopping online, it seems to be a big opportunity. At present, poor credit infrastructure, predominance of debit cards and limited buying power in Africa may have created the perfect scenario in which BNPL services can flourish. In South Africa, the adoption of deferred payment methods saw an increase of 31% in 2020. And Zip's acquisition of South African start-up Payflex may signal BNPL's potential.

But the search for liquidity goes far beyond buying Stan Smith sneakers or a new iPhone, especially in Africa, and BNPL players are well aware of this. Carbon Zero, a payments start-up based in Nigeria, believes offering deferred payments in travel, education and even health may expand the market beyond the retail space.

matt

beeg ups ✊

Black-owned asset manager, Sanlam, is now the largest in the country with over R1 trillion in assets under management (AUM) thanks to a merger with Absa. Let me clarify, the largest black-owned asset manager, not the largest asset manager. That'd be Ninety One with R2.6 trillion in assets under management (AUM).

BEEconomics stats from June this year, prior to the merger, suggest that black-owned asset managers manage around R1.2 trillion, just under 20% of the South African market. That's almost double from 2020's R667 billion. This is largely due to Sanlam restructuring through a partnership with African Rainbow Capital (ARC) in 2020, advancing their broad-based BEE agenda.

Where's the 😈

...in the details. Sanlam exchanged a 17.5% stake of their Investments business (Sanlam Investment Holdings - SIH) for ±R850 million of Absa's investment management unit. That values SIH at ±R4.85 billion, including their new Absa assets. Effectively, Sanlam gets all of Absa's ETF offerings which will be managed by their wholly owned company, Satrix. This excludes Absa's three commodity focussed funds, which also happens to be their largest.

So who benefits? 🕵🏽♂️:

Asset management is a business of scale, Absa conceded to this and now has a share in one of the largest asset managers in South Africa (SA).

Sanlam has effectively eliminated a key competitor through consolidation and will benefit through increased distribution channels.

ARC - Patrice Motsepe's investment company, owns 25% of Sanlam, and benefits from increased exposure to financial services players, including EasyEquities where Sanlam owns 30%.

Opening up for potential synergies with the likes of Tyme bank 👀

Say black-owned again 📣

With black people (as it’s defined in SA ) making up 92% of South Africa's 60 million people, there is a need to bring greater equity to industries, making them more representative of the country's demographics. It's the same plea we had for women in UC's vol.12, where the argument was that equity → equality.

Despite policies like the financial services charter (FSC) committing to transformation at a sectoral level and establishing targets for sector players to work towards from 2002 - SA remains the most unequal society in the world. Many suggest it is the result of a failed BEE program. Citing that BEE schemes haven’t redistributed wealth amongst black South Africans with around 80% of the country's wealth being held by 10% of the population. BEE focused scorecards set to improve black ownership, management control and procurement have only done so for a small group of elite business professionals, leaving the majority to become even poorer.

The investment landscape 🗺

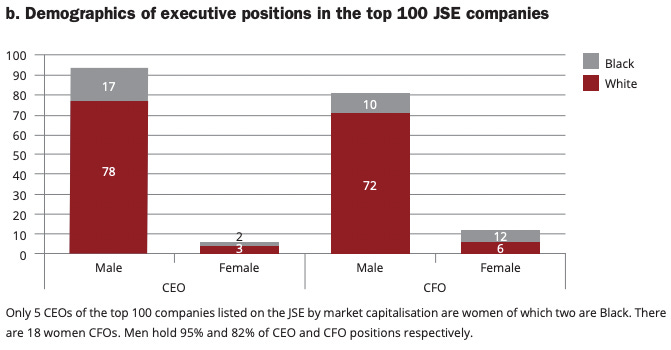

Moving away from ownership to managerial control. The top 100 Johannesburg Stock Exchange (JSE) traded companies show a very unequal race and gender breakdown.

As we step away from the JSE and look at the 55 Black owned asset managers considered in the BEEconomics report, with over R1.2 trillion AUM, we see some skewed but encouraging results:

CEO and Head of the Investment Team are primarily held by men in the majority of firms.

Across all four C-Suite positions women are represented the most in the CFO role.

The Absa deal represents an increasing shift in the colour of the capital that owns asset-management companies in South Africa, with the above stats on black-owned asset managers being more representative (albeit still gender-skewed) of South Africa's race demographics. This is a big topic and requires some big questions:

Does the deal represent a renewed (albeit black) concentration or a distribution of ownership?

What does this mean for the management structures in asset managers in SA?

What does this actually mean for the majority of black South Africans?

karl

claude came across an article about the role unfair advantage can play in startup success

sash really enjoyed this post explaining the thinking behind some famous brands’ logos